The Federal Reserve’s Powerful Medicine That Gives Painful Side Effects

The bad news is that the federal funds rate has not changed in over a year and remains at 5.25% to 5.50%. From the vantage point, the US economy looks good after the Commerce Department reported second quarter GDP at 3.1% from last year. However, that’s my gripe with the Fed’s policy and macroeconomics, in general. “The economy” is not one homogeneous blob.

Just as people are not the same, companies and businesses are not the same. As I explained earlier, there is a better way to look at economics. I categorize S&P 500 companies by their ability to make money and the level of debt they carry. Some companies generate high capital gains and do not require debt. Fed policy usually doesn’t affect their benchmarks at all. Some companies struggle to make a sustainable profit, and if they have a lot of debt, they are the first to experience high profitability and/or economic losses. Guess which category most new farmers fall into?

According to the National Farmers Union, farmers received $5.32 of the $41.83 that consumers spent on the Fourth of July Food this year. Agriculture is not the source of inflation. Unfortunately, the Fed is not able to distinguish between different sectors of the economy and recognize this problem from the beginning. Like a man with a hammer who sees every problem as a nail, the Fed sees the world through the lens of monetary theory and can’t help but hit the whole team.

In the big picture, I’m not too worried if a tennis shoe company goes under, but when the businesses that fail are the hardworking people who grow the crops we all depend on, we should pay attention. If you have very productive fields in a clear area and you rent your land, you will return next year. If you’re young and farming someone else’s land, trying to pay for expensive equipment and a license, $3.75 corn and $10.00 soybeans aren’t going to cut it.

There is another bearish side to Fed policy that I haven’t talked about enough and that’s my fault. I want to thank Mitch Miller, a fellow analyst from near Winnipeg in Canada, for reminding me how the Fed’s current policy is contributing to the stock market selloff. In short, when the Fed began its rate hike campaign in early 2022, they gave money managers the green light to sell assets, knowing that their positions would be supported by a national, well-publicized effort to discounting all prices, including others. which did not contribute to inflation.

As of July 23, futures were short 579,989 contracts of Chicago corn, soybeans and wheat, the largest combined short position. National DTN indices currently show cash corn prices more than a dollar below the USDA’s production cost estimate and soybean prices close to $2 a bushel below their cost estimate. . From a fundamental perspective, the market has become the most volatile, volatile in a long time.

After seeing the first panicked national response to the global pandemic, the main reasons we have lower prices today is because the US is producing more oil and gas and people are back to work, reducing many administrative problems that plagued us. The campaign to raise interest rates began with a flawed analysis of the causes of inflation and more. It exaggerates bearish speculation in the stock market and hurts the American farmer.

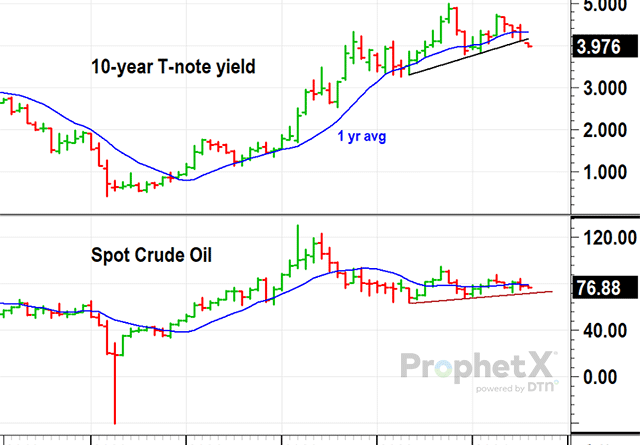

On Aug. 1, the yield on 10-year T-Notes fell to 3.98%, the lowest in six months. The Fed is expected to follow through with a small rate cut in September. For the sake of the big spenders who do the work of growing crops that benefit us all, those rates won’t come down any time soon.

**

The above comments are for educational purposes only and are not intended as specific business recommendations. Buying and selling of commodities or futures or options involves significant risk and is not suitable for everyone.

Todd Hultman can be reached at [email protected]

Follow him on social media X @ToddHultman1

(c) Copyright 2024 DTN, LLC. All rights reserved.

#Federal #Reserves #Powerful #Medicine #Painful #Side #Effects