Planet Fitness: A Comprehensive Way to Drive Investments at Sub-Par Returns

Pgiam/iStock via Getty Images

The Investment Thesis

Planet Fitness (NYSE: PLNT) is a leading franchisor and operator of fitness centers that can benefit from the growing demand for affordable and accessible fitness solutions.

PLNT has achieved significant growth for its members and storage space over the years, following its slightly different nature that attracts the ‘customer’ of a unique practice. The company operated ~2,600 stores across the Q. Its presence is in all 50 states, Puerto Rico, Canada, Panama, Mexico, and Australia. Of these, 2,341 are franchises and 258 are businesses.

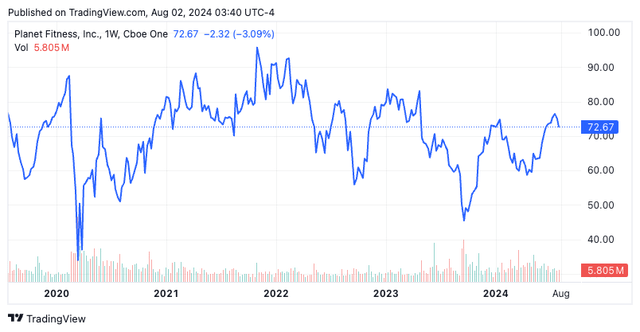

Figure 1

TradingView

It has ~19.6mm members paying as little as $10 per month (although the business has recently implemented some pricing changes that we’ll talk about) and has a contractual commitment to open new stores a ~ 1,000, which shows how managers can manage funds. in the future.

The stock has cycled in ’24 and is flat for the year, with Q2 earnings coming up soon, I wanted to review the company and give my thoughts on where it stands to the numbers.

Details on Q2 earnings

PLNT’s Q1 numbers tell the story of what to expect in future earnings. Sales of $248mm were +12% YoY, driven by higher royalties + new store openings. Overall same-store sales growth was +6.2% YoY, versus franchisee same-store sales growth of +6.3% and franchise same-store sales growth of +6.2%.

Meanwhile, management said that penetration of its Black Card members increased to >62% (+10bps YoY) which added several points to revenue per member. Management now guides +800bps revenue growth to $340-$350mm. Eye-catching adj. EBITDA of $140mm on this top end, ~31% YoY growth. Ideally, it has provisions of 45% adj. EBITDA is in line with FY’26.

Interesting catalysts:

- The opening of new stores provides a wider avenue for managers to drive cash flow – I would go so far as to say that this is an opportunity for the current climate. PLNT opened 25 new stores in Q1 2024 and plans to open ~1,000 new stores under existing commitments. It depends on how the system spends money, but the runway is wide (~ +50% in the current system).

- PLNT tested different price points for the Classic Card membership, eventually deciding to increase the price from $10 to $15 for new members starting this round.r. In particular, it faced a public backlash for this, and executives reported a higher quarterly rate as a result. Long term, the results are unclear, but it’s a bold move for a business known for its low-cost offerings. The risk is with the customer – we’ve heard a lot about low-end customers and how they’re high-end, not knowing what PLNT’s market is.

- PLNT plans to refinance a $600 million loan by September 2025 – based on the facts about cash flow above, reduced cash obligations can be seen as free cash flow.

My overall outlook for the company heading into its Q2 numbers is positive, but there are strong headwinds for the investment debate as I’ll discuss below. The key points taken are 1) the way to move money by opening stores, and 2) the ambitions to run pre-tax sales > 40%. So we need to set regulatory standards against this – that is, to take into account (i) new stores opened, whether they remain on track to reach 140-150 new stores for FY’24 . This is important, since it projects ~ 120-130 devices to be placed with these (hence the tail of money).

I also encourage investors to pay attention to 1) its rebranded sales (management assumes this will make up ~60% of total sales for FY’24), 2) sales per store ( management forecasts ~3-5% this year vs. 5-6% earlier, I would be looking at at least 5% for growth in Q2), and 3) what CapEx is coming in – management guidance at ~25% of sales (by ~ 11% or this care).

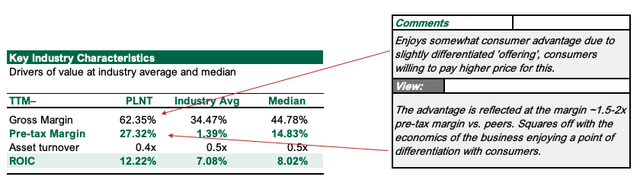

Business characteristics

PLNT enjoys significantly higher pre-tax earnings compared to its peers (27% vs. 1.4%) given its variable and client-specific nature (in my opinion, most clients will “walk” to the Planet Fitness gym). Such buyers are willing to pay a premium for this (full margins are about 2x the industry average) with comparable asset turnover so ROIC is ~5 points ahead of the industry. This depends on the economy of the business you enjoy as opposed to the customers.

Figure 2

Company reports, Searching for Alpha

Other business features worth mentioning:

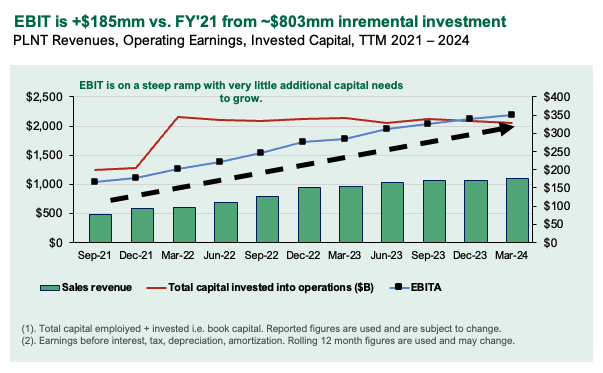

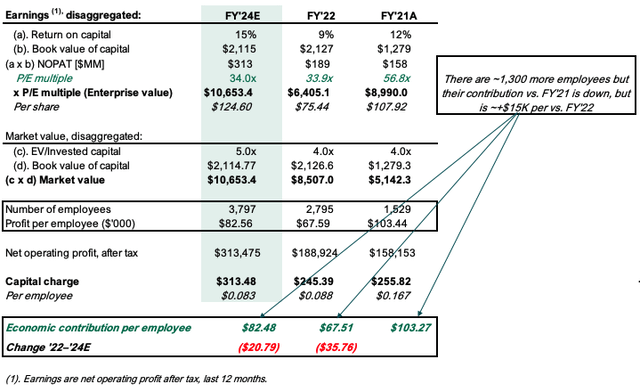

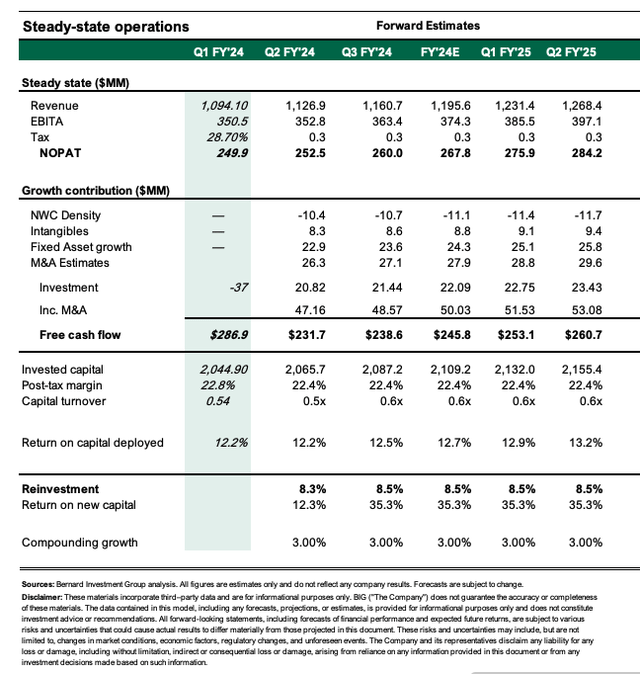

- Pre-tax earnings are +$185mm vs FY’21 with very little incremental revenue. Aimed at ~$900mm to generate this growth, otherwise 23% marginal ROIC. Furthermore, sales have been growing exponentially every year since FY’14 at a CAGR of ~14.6% from $280mm to $1.1Bn in TTM.

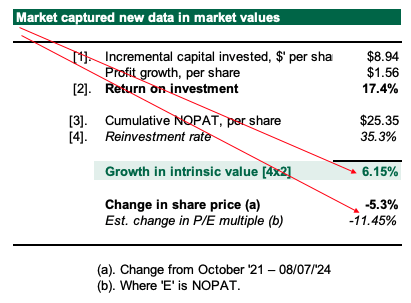

- Most recently, management returned ~$8.95/share in earnings to generate ~$1.56/share in NOPAT growth from FY’21. It reinvested ~35% of total earnings to grow the company’s value by ~6.15%, but considering multiple startups at the beginning of the trial period (>71x NOPAT, 6.5x EV/IC) the return on investment i.e. -5% by ~11.5% of the central frequency. What you pay for is worth it – a lot.

Figure 3

Company records, secretary

Figure 4

Company records, secretary

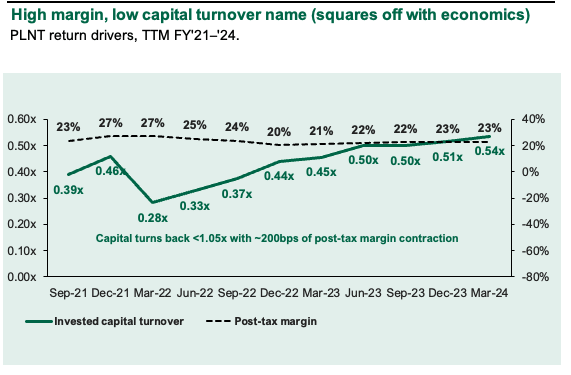

- PLNT earns about 10-12% of the total investment capital invested in the business (including retained earnings) – here I compare PLNT’s Xponential Fitness (XPOF) competition which I believe has superior economic characteristics (see my recent review here). PLNT’s highly intangible asset (ie, economic goodwill) attracts ~23-25% of the post-tax exemptions for TTM purposes against a turnover of ~0.55x. XPOF makes ~18-20% at 0.9x income. My numbers project PLNT and XPOF to generate ~12-13% and ~15-16% ROIC in FY’24, respectively. This leads me to XPOF.

Figure 5

Company records

- To make matters worse, economic profit per employee fell by ~$21K vs. FY’21 – though, it’s ~+$15K vs. FY’22. There are more than 1,300 employees, but the contribution has decreased since 3 years ago. My guess is that this comes with the growth of PLNT – it is adding stores very quickly that require staff to be adjusted. Therefore, the power of “human capital” is high – but on the other hand, the capital/employee charge is ~1/2 of FY’21 as it can distribute labor costs in many places now.

Figure 6

Company records, Secretary

Balanced risk/reward potential

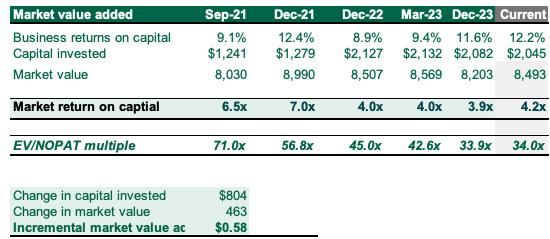

Importantly, there are three factors that support the balanced risk/reward view – 1) high expectations (power), 2) valuations (we’re still 34x NOPAT), and 3) business value or growth order these payments from me. vision

Quality assurance

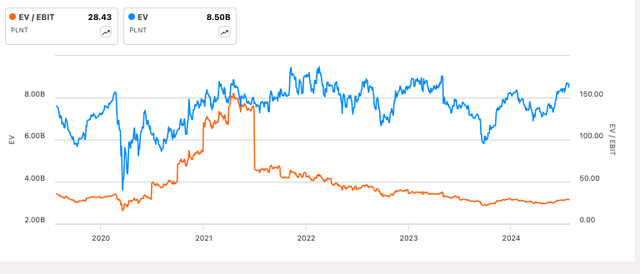

- It has been a significant increase from the high in FY’21 – despite the growth numbers mentioned earlier, EV has sold down since FY’22 when EV/EBIT went from a high of 152x to ~28x when I wrote (Figure 8). The business has returned >4x EV/IC, which is a stretch in my view as I feel ~4x is correct.

Figure 7

Secretary, company documents

Figure 8

Looking for an Alpha

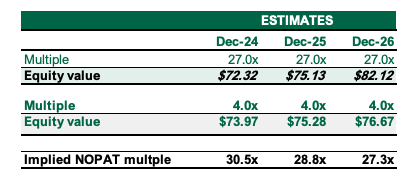

- Around 4x EV/IC seems reasonable as mentioned earlier given IP + franchise economics – this allows the figure to be reduced to ~27x NOPAT in FY’26E. On the other hand, pressure at 30x NOPAT today takes us to ~$73/share, where it is sold today. Disappearing multiple to 27x to support ~$76/share in year 3 with high cash flow rate + ROIC/FCF projected by my numbers (see: Appendix 1).

Figure 9

Author’s guesses

Risks to the thesis

Risks above the thesis include 1) greater than 15% sales growth from FY’24-26 as this gets us >$80/share valuation, 2) ROICs at 15% or more, and 3 ) investors pay > 32x NOPAT.

On the other hand, investors should pay attention to the current start of the broader equity markets, and the correction of the broader correction. This can be preceded by environmental risks and/or financial growth and tariff factors.

Investors must fully understand these risks before proceeding.

In short

PLNT’s franchise is well established and management has a broad pipeline of cash flows for years to come. While these are good, the returns at which it can use these funds are not attractive enough to warrant market value or multiple numbers, in my view. I encourage investors to pay attention to the section that covers the company’s future earnings forecast. My numbers take me to ~4x EV/IC, which supports ~$73/share today, where the stock is trading as I write. So, net-net, I measure the catch.

Appendix 1

Secretary

#Planet #Fitness #Comprehensive #Drive #Investments #SubPar #Returns